The Whitcomb Center for Research in Financial Services, originally named the New Jersey Center for Research in Financial Services, was established in 1986. The center has been active in funding research, acquiring up-to-date financial databases and underwriting faculty and doctoral student participation in prominent academic conferences.

Through its activities, the Whitcomb Center aims to promote and facilitate research in financial services, foster interaction between the academic and business/finance communities, and bring national recognition to the research being done at Rutgers Business School - Newark and New Brunswick.

In order to promote finance and economics research, the Whitcomb Center subscribes to the Wharton Retrieval Data System (WRDS). Learn more about the resources available by clicking the link below.

About David Whitcomb

David Whitcomb is Founder and Chairman of Automated Trading Desk, LLC, the first expert/machine learning system for fully automated limit order trading of securities. ATD traded about 200 million shares/day (about 5% of total Nasdaq volume and over 4% of total NYSE volume). ATD was named the Charleston area’s Emerging Business of the Year in 2000. Whitcomb won the regional 2001 Entrepreneur of the Year award (sponsored by Ernst & Young, USA Today, and Nasdaq) for financial services for the Carolinas and was a finalist in the national competition. He was named the Outstanding Financial Executive, 2003, by the Financial Management Association. A conference was held at Rutgers University in his honor and the book Essays in Microstructure in honor of David Whitcomb [Brick, Ronen, Lee, World Scientific 2006] resulted.

Whitcomb received his Bachelor's degree in economics from Babson College in 1963 and his Ph.D., also in economics (with distinction, Friedman Prize), from Columbia University in 1968.

He is also Professor of Finance Emeritus at the Graduate School of Management, Rutgers University.

Contact Us

| Professor Ivan Brick Executive Director 973-353-5155 |

| Professor Tavy Ronen Vice Director 973-353-5272 |

| Professor Daniel Weaver Associate Director 848-445-5644 |

Faculty Spotlight

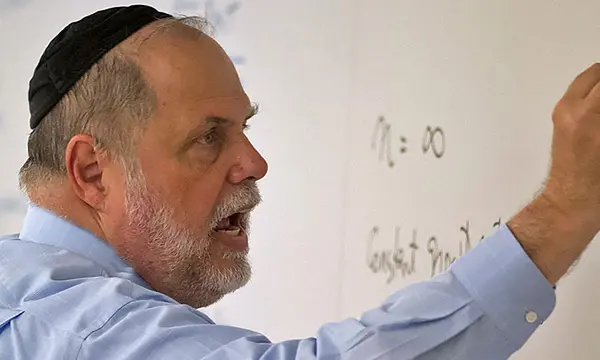

Ivan Brick

Dean’s Professor of Business

Professor Ivan E. Brick joined Rutgers Business School – Newark and New Brunswick in 1978. He served as Chair of the Finance and Economics department from 1996 until 2023. Professor Brick is the Executive Director of the Whitcomb Center for Research in Financial Services.

Professor Brick has published numerous papers...

Faculty Spotlight

Tavy Ronen

Professor, Director of the Business of Fashion Programs and the Center for Business of Fashion

Tavy Ronen is a Professor of Finance at Rutgers Business School. She has a Ph.D. in Finance from the Stern School of Business at New York University and has been on the faculty of Columbia University, New York University, and the University of Wisconsin at Madison.

Tavy’s areas of expertise...

Faculty Spotlight

Dan Weaver

Professor and Director of Master of Financial Analysis

Daniel G. Weaver’s research and teaching focus is on security design, security market structure, and e-commerce. He has over 35 published articles. He has published in the Journal of Finance, Journal of Financial Economics, Journal of Financial Markets, and Journal of Financial and Quantitative Analysis, among others. Recent...