The North Eastern corridor of the country is home to some of the world’s most prominent financial institutions. New Jersey, in particular has some of the nation’s finest financial institutions, with many institutions moving its offices to the state.The center marshals the intellectual resources of the region in examining the relevant issues facing the industry.

The center exists to promote research on financial institutions and to act as a think tank and interface between the following four constituencies:

Constituency 1 - The practicing professional

Of significant importance to the Center, this constituency is served through the research conducted by the Center and through the organization and sponsorship of conferences on topical issues of concern to the industry. The Center conducts forums that enables executives to present and debate their positions, and in doing so assists in the dissemination of information between executives.

Constituency 2 - Regulators

Financial institutions face unique regulations from the regulatory agencies like the Federal Reserve Board of Governors, the Office of the Comptroller of Currency, the State Banking and Insurance Agencies, the Securities and Exchange Commission, etc. The Center will assist as a liaison between regulators and industry, helping both sides debate and examine issues facing them.

Constituency 3 - Academia (professors and Ph.D. students)

The Center enables academia to analytically examine research issues of interest to industry, allowing industry and academia to have a mutually beneficial exchange of ideas. It assists in buying relevant databases, funding journal submission fees, and sponsoring theoretical and empirical research on topical issues. Doctoral dissertations are sponsored on more analytical topics. A Financial Intermediation Seminar is held approximately twice a month wherein presenters have been from industry, regulatory agencies, Rutgers, other academic institutions, and PhD students.

Constituency 4 - Students

Given the unique nature of the industry, more courses that are directly applicable to the industry will be offered to Rutgers’ students, providing industry access to a well trained, focused group of potential employees.

The Financial Institutions Center at Rutgers Business School will serve as an interface and think tank between industry, regulators and academia. The center seeks to serve industry leaders and practicing professionals through research conducted by the center and conferences on topical issues of concern to the industry. The primary themes of research will focus on the unique regulations imposed by regulatory agencies.

The center will initially host two or more conferences featuring keynote and panelists who are highly regarded in the industry. The conference will provide a neutral setting for industry leaders, regulators, academia and students, to engage in relevant debate on important issues.

The financial institutions that the center seeks to serve are commercial and savings banks, hedge and mutual funds, pension funds and their investment managers, and insurance companies. Law firms that assist the financial industry in regulatory and legal compliance will be also be served by the center. Participation by these organizations at conferences will provide beneficial networking for shared business opportunities.

Reasons for Examining Financial Institutions

Financial institutions (defined here onwards as commercial banks, savings associations, investment banks, venture capital firms, hedge and mutual funds, pension funds and their investment managers, and insurance companies) provide financial intermediation services that have an important and unique impact on the health of the US economy. These services cannot be replicated by the non-financial sector, and allow financial institutions to play an extremely important role which is well recognized by the Federal Reserve and other government regulatory agencies, Congress and the corporate sector. Financial institutions face constant change with ever-increasing challenges due to globalization, increasing corporate governance and opaqueness issues in financial transactions, changes in regulations, and rapid technological innovations. These trends are likely to continue to affect the industry at a hectic rate in the future. Members of the Center target studying the many issues facing this sector, bringing an analytic, but practical, framework to its analyses.

Faculty Spotlight

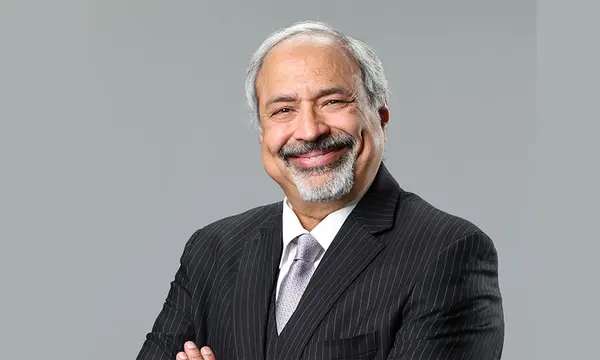

Darius Palia

Professor, Thomas A. Renyi Endowed Chair in Banking, Director of Rutgers Financial Institutions Center, and Department Chair

Thomas A. Renyi Endowed Chair in Banking

Founding Director, Rutgers Financial Institutions Center

Website: https://sites.rutgers.edu/darius-palia/

Professor Palia is an internationally renowned scholar in law and economics, banking, and corporate governance. He earned a PhD in Finance from the Stern School of Business at New York University, and he has been...

Contact the Rutgers Financial Institutions Center

Professor Darius Palia

Director, Rutgers Financial Institutions Center

Rutgers Business School–Newark and New Brunswick

1 Washington Park

Newark, NJ 07102

Phone: 973-353-5981