Full employment minus strong economic growth not adding up

The Fed Dilemma: To increase interest rates or not

By Farrokh Langdana, Director, Executive MBA Program & Professor of Finance and Economics

The Fed lies on the horns of a dilemma. On one hand, current unemployment at 4.3% is even below what has been considered the benchmark unemployment rate that exists at "full employment" which is loosely defined as 4.5% unemployment. So, should the Fed soft-land the economy by raising rates?

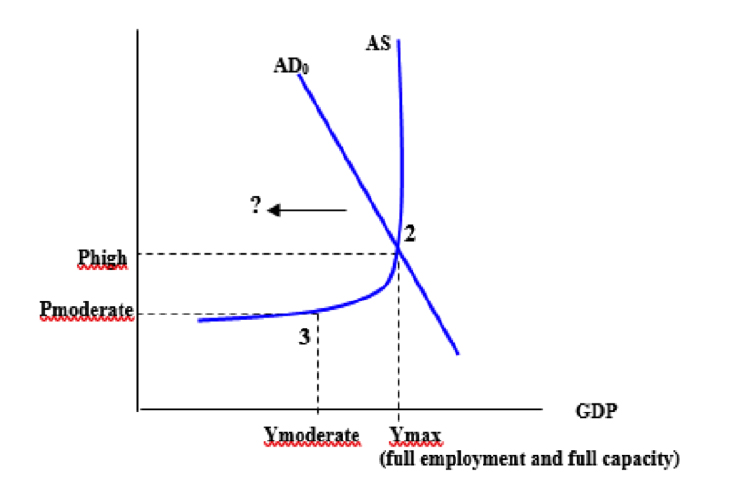

In other words, “cool down” the economy by contracting monetary growth, and shifting the Aggregate Demand to the left, as presented in Figure A?

Figure A.

Well, there’s a complication. Historically at such low rates of unemployment, GDP growth has been a sizzling 5-6%, which has been the "maximum" rate of growth for the US, denoted by Ymax in the diagrams. At this time (October 2017), GDP growth is only 3.1%, following a long stretch of anemic growth over the last 2 years.

And what about inflation? At the overheating point (Figure A), inflation should be at Phigh. Well it’s not. Current inflation is around 1.8%, even below the Fed’s ‘sweet spot’ of 2% inflation.

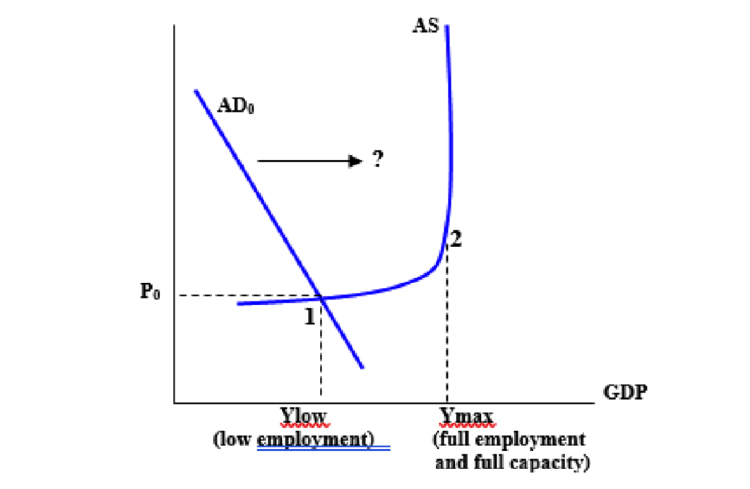

Hence the Fed’s dilemma. Should the Fed now do the opposite and jump-start the economy by increasing monetary growth and LOWERING rates, and attempt to shift the Aggregate Demand to the right, as presented in Figure B?

Figure B.

Hmmm. What gives? Are the statistics erroneous? Is the low unemployment rate a misleading statistic? Should we be looking at U6 (U3 + discouraged workers + marginally attached workers + part-time workers) and not U3 (the official unemployment rate) for the real unemployment rate?

Or is the inflation rate "broken"? After all, overheating now happens asymmetrically in speculative asset price (SAP) bubbles.

When economies overheat today, instead of high inflation manifesting itself across entire economies, we see sharp price rises (bubbles) in highly localized markets such as housing, commodities, and dotcoms. For example, inflation was only 2.2% when Fed Chairman Greenspan attacked the SAP bubble in dotcoms in 2000, and overall inflation was benign when Bernanke attacked the SAP bubble in housing in 2007. So maybe looking at the overall inflation rate is misleading.

And then what about the monstrous liquidity ($4.5 trillion) that the Fed has injected into the economy under the guise of Quantitative Easing (QE) to bail-out all those caught holding the rotten mortgage-backed securities in the subprime crisis?

This huge liquidity needs to be sucked back for sure, and hence interest rates will indeed rise if this were to happen - in the parlance of the Fed today, it needs to "unwind" its balance sheet.

Yes, The Fed is on the horns of a dilemma: To decrease M, increase interest rates and soft-land (Figure A) or to do the opposite, which is to increase M and keep rates low (Figure B). A macroeconomic Hamlet would agonizingly ponder: To soft-land or not to soft-land, that is the question?

Farrokh Langdana is solely responsible for all the comments and opinions expressed here. He acknowledges valuable technical assistance from Prachi Joglekar, REMBA 2017.

Press: For all media inquiries see our Media Kit