Faculty Spotlight: Instructor brings state, local tax expertise to graduate program

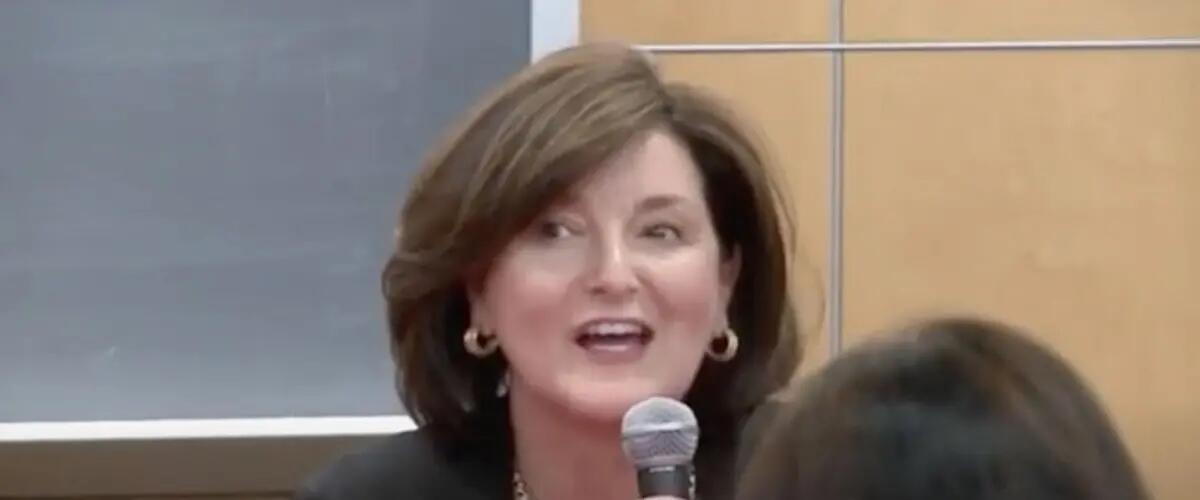

Janet Bernier

Part-time Lecturer

Teaches: State and Local Tax Constitutional Issues

Program: Rutgers Master of Accountancy in Taxation

Full-Time Job: Tax Partner, Principal, BDO, USA LLP

Leader for BDO’s Northeast Region, State and Local Tax Practice

Her career: "Out of law school, I began as a tax litigator and handled some interesting and precedential tax cases. After focusing my energy on tax controversy and litigation for a few years, I went into public accounting for the diversity of experiences. I had the opportunity to be part of collaborative client service teams that bring together tax practitioners with different areas of expertise or financial audit experience. I gained varied experience, whether it was transactional tax (mergers and acquisitions), state and local tax, audit defense or tax planning. I enjoy the variety and the multitude of opportunities within public accounting firms. My clients over the years have included high net worth individuals ("Titans of industry," presidential appointees and sports players) as well as Fortune 100 companies and industries such as banking, manufacturing and e-commerce."

How she leverages that career experience in the classroom: "In order to connect with the class and bring tax topics to life, I like to share relevant client experiences (on an anonymous basis), some of the challenges and the outcomes and how we achieved the successful outcomes. When we’re able to talk about those real-life experiences, it brings the lessons to life and helps these graduate students see what the practical applications are of tax laws, tax policies and judicial cases. It also makes them see the opportunities for themselves as tax practitioners."

Why she teaches: "I enjoy the energy of the classroom. It’s a symbiotic relationship where I learn from the students' questions and insight, too. It’s a mutual discussion, a sharing of ideas and fresh perspectives. Teaching tax is something I’ve done over the years at the college level, at the graduate level and at law school. I’ve also taught English in Marrakesh (Morocco)."

Why did she focus on tax law: "As a detail-oriented person, I like the analytics of synthesizing and applying tax codes. For state and local taxes, it's like solving a Rubik's cube by managing conflicting and non-uniform tax laws of multiple states and localities to yield favorable results for our clients. I enjoy the challenge of finding business solutions that are aligned to the multi-state tax codes."

Why she finds state and local tax so interesting: With federal tax, there’s only one tax code, the Internal Revenue Code. What’s so fascinating about state and local tax is, I have 50 different tax codes and within each state, I have multiple tax types, so it goes back to the variety.

The impact of her work: Practicing in the area of state and local tax, I’ve had the opportunity to go to about 30 different states for client matters. I’ve had the opportunity to work not only with the tax offices but some of the governors on tax planning and creating new legislation. What we call state and local incentives, creating businesses and bringing jobs in other regions by working to identify favorable tax policy.

- Susan Todd

Press: For all media inquiries see our Media Kit